Getting a

life insurance policy

is one of the rites of passage to becoming an adult. However even if you have made the right choice in getting a life insurance policy you may not understand what that policy means for you. Most individuals with life insurance remain confused or are skeptical about what their insurance policy can do for them. So, let's address 10 of the most common myths or concerns people have when it comes to life insurance.

1. The Value of a Policy

Most people have life insurance but they have no idea what the value of their life insurance policy is, and some people don't know how much money their loved ones will receive as their beneficiary. Part of this occurs because of the way life insurance policies are set up. When speaking of term insurance, this increases in value up to a certain point in a person’s life, usually when they hit retirement age. Permanent life insurance, on the other hand, increases in value until you die.

As for

term insurance

, the policy may decrease in value if that person does not continue to pay into their life insurance policy. Therefore, individuals may say they have a life insurance policy of $100,000 but, in reality, that policy may be worth more or less. One way to know how much your life insurance policy is worth is to look at your monthly or quarterly statements from your life insurance provider.

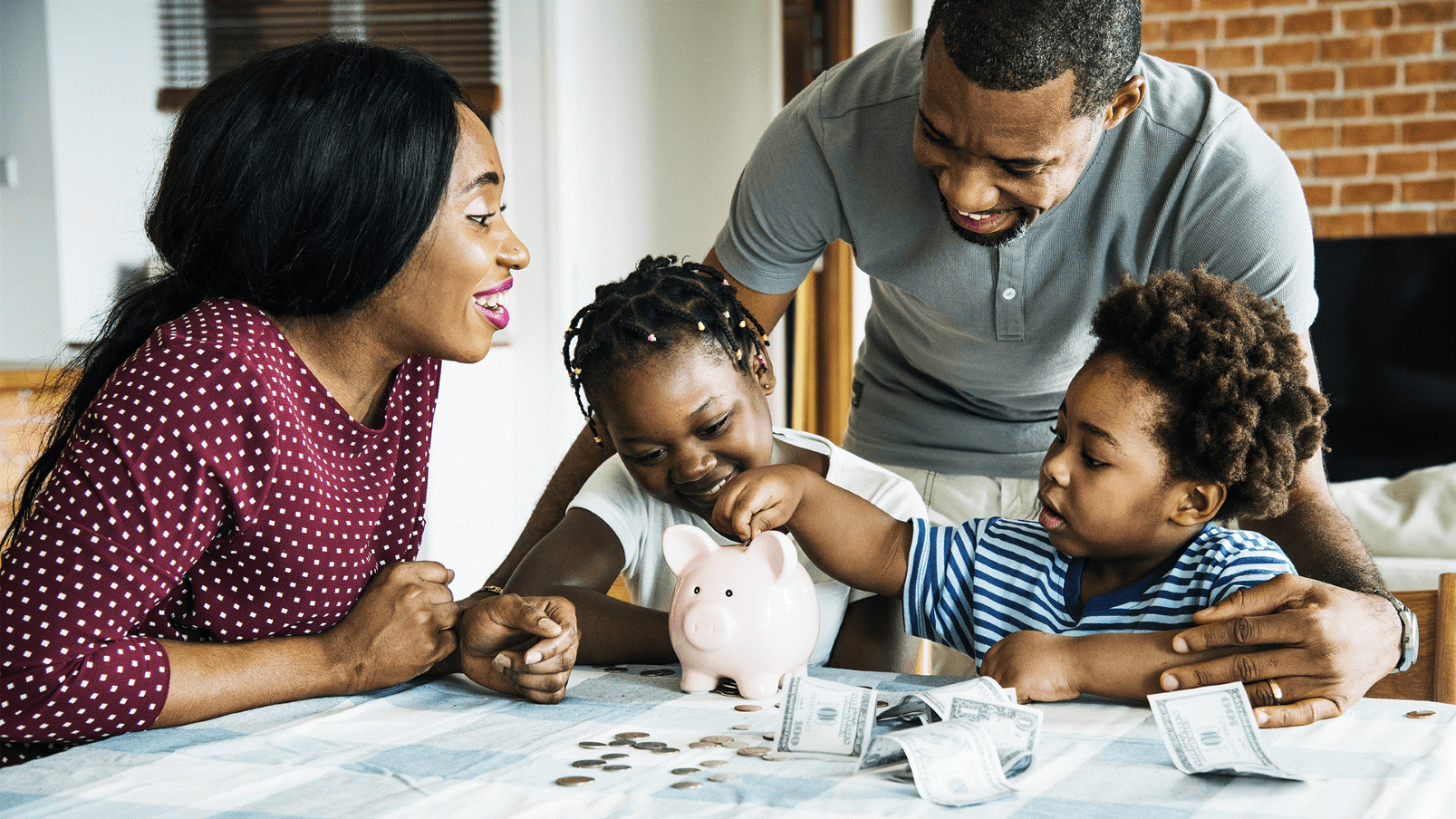

2. Why Life Insurance is Necessary

Most people don't realize why they need life insurance. Life insurance money is paid out to the people known as your survivors or beneficiaries. When you or a loved one passes, that death was typically unexpected and due to this, there will most likely be bills or accounts left unpaid. Your death can leave your survivors with debt that you have yet to pay, such as student loans or credit card debt. It also involves a large sum of money to be paid for funeral services and burials.

This expense is hefty in other ways as well, as your survivors are hit with a sudden stage of grief. The last thing you want your surviving relatives to have to deal with is finding the money to be able to take care of final costs. That’s why life insurance exists -- so that you can provide that financial benefit for your surviving family members.

3. Flexibility of Life Insurance Policies

A lot of people don't understand how flexible life insurance policies are. In fact, according to Business Insider, nearly 35% of individuals who know that their significant others have life insurance policies have no idea what those policies are. Part of this is because we overlook the importance of discussing our life insurance policies with our family members. After all, when you buy a life insurance policy in your 20's or 30's, the life insurance may not be necessary for 40 or 50 years. By then you may have forgotten what kind of policy you have, and you may not have thought to discuss this with your significant others.

In many instances people tell their significant others they have life insurance, but they don’t address the insurance policy in detail. Part of this comes with the stigma of death. We don't want to talk about death even though it is inevitable for all of us. Therefore, discussing details of what to do when you die is not a priority for most individuals.

4. How to Change or Update Life Insurance Policies

Almost 80 percent of people who have life insurance have never changed or thought of changing their policies. Think about this: when you first get a life insurance policy, chances are you’re in your early 20's or 30's. You may have a spouse or a young child. Most likely, when you purchase this policy, you are young and healthy and so is your new family. As you age, your life experiences, goals and needs change dramatically. Your children grow up, go off to college and start having families of their own. You and your spouse are most likely approaching retirement age once you are in your 60's.

All of this means your life needs are going to change once again. Your life insurance policy needs to reflect the current state of your living expenses. So, you should consider updating your policy every 10 years at a minimum, in order to maintain a valuable life insurance policy that reflects your financial needs.

Another consideration is the increase in the cost of living. As we age, the cost of living increases. Therefore, the amount of money that you would need to provide to your significant other upon your death will increase from the time you purchased your life insurance policy. You want to consider how much value your life insurance policy holds as you age and make sure it is increasing in value in relation to the standards you maintain.

A third reason to change your policy is to update the beneficiaries. You may choose to have your spouse or significant other as your beneficiary on your life insurance policy, but what if you get divorced or they die before you? Who will be the beneficiary then? Do you have your children updated on your policy so they can be the beneficiary? If you do not have a living beneficiary on your life insurance policy, it will be completely worthless upon your death.

5. Term vs. Permanent Life Insurance Policies

Over half of the people who have life insurance don't understand the differences between term and permanent life insurance products. If you have term life insurance, this means you have life insurance coverage for a specific period of time. For example, you may take out a term life insurance policy for 10, 20 or 50 years. After this term is up, your life insurance policy will begin to decrease in value. If you choose permanent life insurance, this provides lifelong protection and coverage for as long as you're living.

One reason why people may choose term life insurance is because it is a cheaper policy in comparison to permanent life insurance. You may also be later in your years, i.e. 40 or 50, and believe that a 10 or 20 year policy will suffice. Another thought as to why individuals go with term life insurance is because with a return of premium rider, they can cash in their life insurance policy once they hit retirement age. This can be done to help pay for unexpected expenses such as healthcare costs or to fund living expenses at a later age. Most people don’t realize you can take the cash value from your permanent life insurance and use it for living expenses as well.

6. How to Research Your Life Insurance Options

When it comes to purchasing a life insurance policy, many people do not research their options before buying a policy. These individuals are most likely purchasing life insurance through a “door-to-door” salesman or on a whim. If you want to get the best value for your money when purchasing life insurance, it’s best to

speak to a life insurance professional

for guidance. This ensures you are selecting the right policy for your needs. It also gives you the opportunity to ask questions and learn more about what your policy can do for you.

Another way people purchase life insurance policies is through their workplace. About 65% of individuals who purchase a life insurance policy did so through their jobs. When you buy life insurance through your workplace and then change jobs, this can adversely affect the value of your life insurance. Also, if you are paying into your life insurance policy through your paycheck in a direct deposit situation, you want to make sure to update any changes in employment. You also need to understand whether or not your employer is matching the funds you contribute to your life insurance policy. Otherwise, you may not be seeing the valuation of your life insurance policy later in life because you did not realize your employer was no longer contributing to the plan.

7. How to Utilize Life Insurance Money

Most people have no idea what life insurance money can be used for. Mainly, life insurance money is used to help cover financial cost that are left behind when a person dies to cover funeral expenses. However, this money can also be used to pay outstanding debts, unpaid mortgages, educational expenses, and even a loss of income for a beneficiary, such as a stay-at-home or bedridden spouse. Having life insurance simply provides a piece of mind for you, as well as your surviving family – it grants everyone the understanding they are taken care of in the event of your unexpected death.

8. Costs of Life Insurance Policies

People can be intimidated when purchasing a life insurance policy due to the cost of the policy itself. However, as with anything you purchase, you can buy the most expensive life insurance policy or you can go with the least expensive life insurance policy. Any life insurance that you purchase for your significant other or dependents is going to provide some financial support in the case of your death. Of course, if you want to provide substantial support then you may need to go with the more expensive option for your life insurance coverage.

One way to save money when purchasing life insurance is to keep up your health. If you do not smoke, have no health problems, and do not have any other risk factors, you can get a life insurance policy relatively cheap. According to Forbes, for example, you could pay less than $500 a year for a term life insurance policy for 20 years that is worth $1 million paid upon your death (this example is for a non-smoking individual in their 30's). On the other hand, if you're a smoker or you have health problems, you may have to pay almost three times more for coverage. In fact, you could be declined denied coverage for having these issues. Those are some of the reasons it is so important to purchase life insurance early in your life.

9. Using Life Insurance Money While Living

Did you know that you can use your life insurance as a form of investment for your personal retirement funds? If you choose a permanent life insurance policy, you can use this money as a boost to your bank account – you can take a portion of the cash value from your life insurance policy. Apply this to an annuity and you will have a payment until the end of your life. It is a reliable way to have money coming to you each month and it offers a buffer for individuals who are on Social Security. You can also use it for large expenses, such as to pay for your grandson's college education or for major repairs on your home.

According to AARP, you do not have to pay penalties or taxes in most cases on the cash you take from your policy. Keep in mind if you do this, however, you're decreasing the permanent life insurance policy amount that would go to your beneficiaries.

10. Cashing in Policies Upon Death

Over 50% of individuals who have life insurance policies believed their insurance companies would pay out for their policy if they died. That means 30% are not even sure if their insurance policy would be paid upon their death. This is a concern considering life insurance policies are designed to give individuals a piece of mind that their financial expenses would be covered following their death. One way to overcome this is to stay up to date and knowledgeable about your life insurance policy.

At the same rate, 34% of individuals felt sure they knew what to do to collect the payout for their health insurance life insurance. That leaves nearly 75% of individuals who have life insurance who are unsure of how to cash in their policy. If you do not know how to cash in your health insurance policy, know your beneficiary probably won’t be sure either. One way to solve this problem is to speak with a life insurance professional who will walk you through the process.

Take control of your life insurance policy today. Whether you are interested in purchasing a policy or you want to update an existing policy, we can help. Here at Symmetry Financial Group, our goal is to create custom policies that best suit the needs of your family. We will answer your questions and work with you to find the best policy for your family today. Do you still have questions about life insurance? Check out our

Guide to Life Insurance

to learn more. If you are interested in getting coverage,

request a quote

today!