Have you had your

life insurance policy

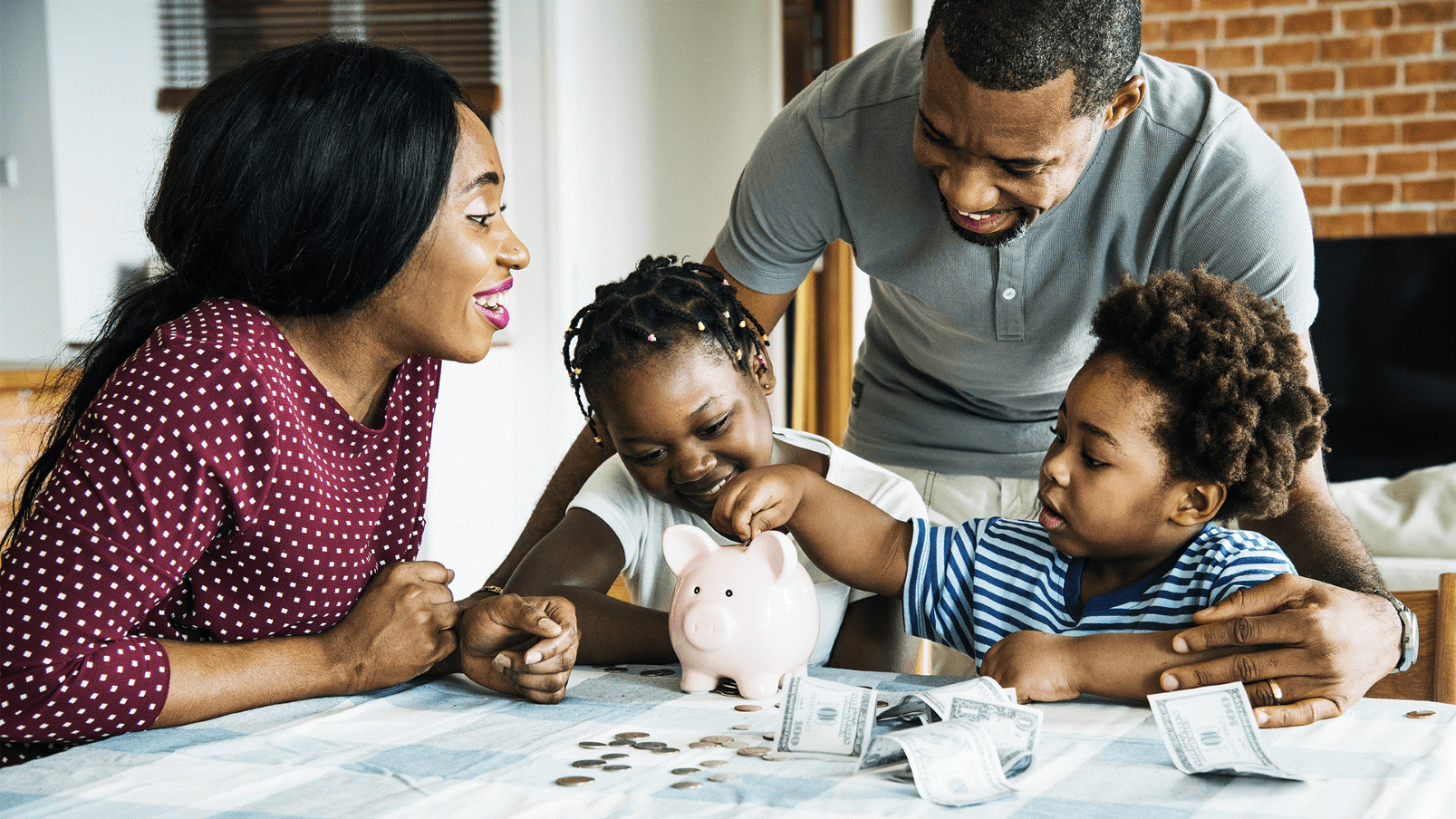

for a long time? Are you a new life insurance policyholder and wondering what’s next? When you first get a life insurance policy, you are most likely in your 20's or 30's and you may have a spouse and/or a young child. When you buy this policy, you and your new family are more likely to be young and healthy.

As you age, you and your family’s needs change and this means your life insurance needs are going to change as well. Your life insurance policy needs to reflect the current state of your living expenses, health, and financial needs. This is where an annual policy review is helpful in assessing where you stand.

Do you still need the same amount of coverage?

Have you recently

paid down debts

such as mortgages and loans? Are your children grown? Over time, your coverage requirements may be less, and if they are, you might be able to adjust your coverage. Or, if you have incurred more debt, had another child, or your standard of living has raised due to a career change and a larger income, you may consider increasing your coverage amount.

Has your health changed?

When purchasing your policy, you may have noticed that premium amounts vary based on many factors such as your age, health, and lifestyle. One way to save money when purchasing life insurance is to prioritize your health. If you do not smoke, have no health problems, and do not have any other risk factors, you can get a life insurance policy at a lower rate. On the other hand, if you're a smoker or you have health problems, you may have to pay almost three times more for coverage.

When reviewing your policy, if your health has improved, and ailments that were once an issue are now well-controlled (or gone completely ex: quitting smoking), you may now qualify for a lower rate. If you developed a severe health condition that would prevent you from obtaining a new life insurance policy, you could explore your policy’s conversion options.

Many

term life insurance

policies can be converted to

permanent coverage

without medical exams (keep in mind that your premium payment will increase when you convert policies).

Keep your information current

If any of your personal information has changed, such as a new address, a new phone number, a different bank account, or a change in beneficiaries;

alert your agent

. This is important because if your policy is nearing expiration, or should there be a problem with your payment, your agent will be able to contact you quickly to avoid a lapse in coverage.

If you need your agent's contact information, we can help -

contact us

today!

Your agent is here to help

Your insurance agent will be able to remind you what your policy covers, if there are any gaps in your coverage, and determine if a policy change is needed based on your needs and budget. Tailoring your insurance policy to your current lifestyle boosts coverage where needed and reduces it where you don’t. Additionally, your policy may include benefits you didn’t realize you had.

Schedule an annual policy review today!

When was the last time you reviewed or updated your life insurance policy? It’s important to schedule an annual policy review - and to make it easy, your Symmetry Financial Group agent can review your policy and offer guidance over a simple video consultation.

Whether you want to update an existing policy, add additional coverage, or you are interested in

purchasing a policy

, we can help. Here at Symmetry Financial Group, our goal is to create custom policies that best suit the needs of you and your family. We will answer your questions and work with you to find the best policy for your needs.

Do you have questions about life insurance? Check out our

Guide to Life Insurance

to learn more. If you are interested in getting coverage,

request a quote

today!